Key Retirement and Tax Numbers for 2024

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2024.

Estate, gift, and generation-skipping transfer tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2024 is $18,000, up from $17,000 in 2023.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2024 is $13,610,000, up from $12,920,000 in 2023.

Standard deduction

A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2024, the standard deduction is:

- $14,600 (up from $13,850 in 2023) for single filers or married individuals filing separate returns

- $29,200 (up from $27,700 in 2023) for married joint filers

- $21,900 (up from $20,800 in 2023) for heads of households

The additional standard deduction amount for the blind and those age 65 or older in 2024 is:

- $1,950 (up from $1,850 in 2023) for single filers and heads of households

- $1,550 (up from $1,500 in 2023) for all other filing statuses

Special rules apply for an individual who can be claimed as a dependent by another taxpayer.

IRAs

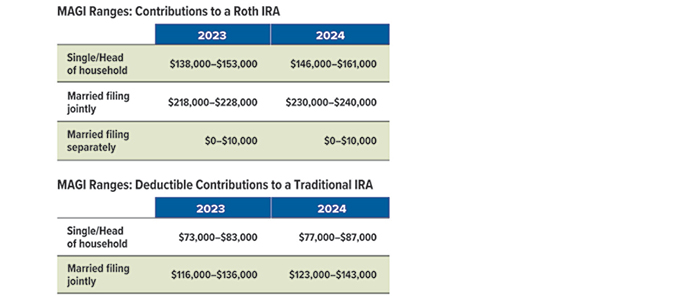

The combined annual limit on contributions to traditional and Roth IRAs is $7,000 in 2024 (up from $6,500 in 2023), with individuals age 50 or older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see table). For individuals who are active participants in an employer-sponsored retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see table). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

Note: The 2024 phaseout range is $230,000–$240,000 (up from $218,000–$228,000 in 2023) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered. The phaseout range is $0–$10,000 when the individual is married filing separately and either spouse is covered by a workplace plan.

Employer-sponsored retirement plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $23,000 in compensation in 2024 (up from $22,500 in 2023); employees age 50 or older can defer up to an additional $7,500 in 2024 (the same as in 2023).

- Employees participating in a SIMPLE retirement plan can defer up to $16,000 in 2024 (up from $15,500 in 2023), and employees age 50 or older can defer up to an additional $3,500 in 2024 (the same as in 2023).

Kiddie tax: child’s unearned income

Under the kiddie tax, a child’s unearned income above $2,600 in 2024 (up from $2,500 in 2023) is taxed using the parents’ tax rates.